UN Vote and Geopolitical Realignment Around Western Sahara

The UN vote expected at the United Nations Security Council fits into a diplomatic sequence dominated by the notion of realism. The resolution text under discussion is described by several capitals as concrete support for Morocco’s autonomy plan for Western Sahara. It emphasizes a pragmatic outcome, turning the page on ineffective approaches and returning international diplomacy to its fundamentals: stability, regional security, and the prosperity of populations.

Signals from Washington, reiterated in New York, support the Moroccan option as the only viable negotiation basis. This stance has strengthened as the international community demands tangible results, particularly for the inhabitants of the contested territory and the regional value chains that cross West Africa. At stake is the consolidation of the Kingdom’s role in energy, logistics, and food agendas.

Positions at the Security Council and Bloc Dynamics

Discussions at the Council reveal limited but structuring fault lines. The United States advocates for explicit support of the plan, while some actors prefer a more balanced wording. Arab and African countries favorable to Morocco’s territorial integrity adopt a convergence language, betting on durable pacification that supports investment and employment.

| Actor 🏛️ | Declared Position 📄 | Main Motivation 🎯 | 2025 Signal 🔎 | Veto Risk ⛔ |

|---|---|---|---|---|

| United States | Support for the autonomy plan | Realistic approach and regional stability | Active coordination in New York ✅ | Low |

| United Arab Emirates | Constant support for the Moroccan initiative | Alliances and targeted investments | Strengthening partnerships 🤝 | None |

| European Union (trends) | Constructive caution | Legal and economic balances | Opening to green projects ♻️ | Very low |

| Russia | Decisive vote depending on final wording | Margins of multilateral influence | Last-minute arbitration 🕊️ | Moderate |

For Moroccan actors in employment and business, these diplomatic variables are not abstract. They condition access to multilateral financing, legal security for projects, and essential logistics corridors for exporting to West Africa. The vote’s outcome is now measured as much in political signals as in career prospects.

- 🧭 Reference point: the autonomy plan structures investor expectations.

- 📈 Opportunity: acceleration of projects in the Southern regions.

- 🛡️ Guarantee: reduction of perceived country risk.

- 🤝 Alliances: more visible pro-stability coalitions.

- 🧩 Consequence: reconfiguration of talents sought by recruiters.

To deepen the American position, a detailed insight on the diplomatic initiative led by Washington puts into perspective the levers influencing the final text.

From this perspective, the UN agenda becomes an HR barometer: skills, mobility, and training are reconfigured around a horizon of reinforced stability.

Expected Effects on Morocco’s Economy and Employment, with a Focus on the Southern Regions

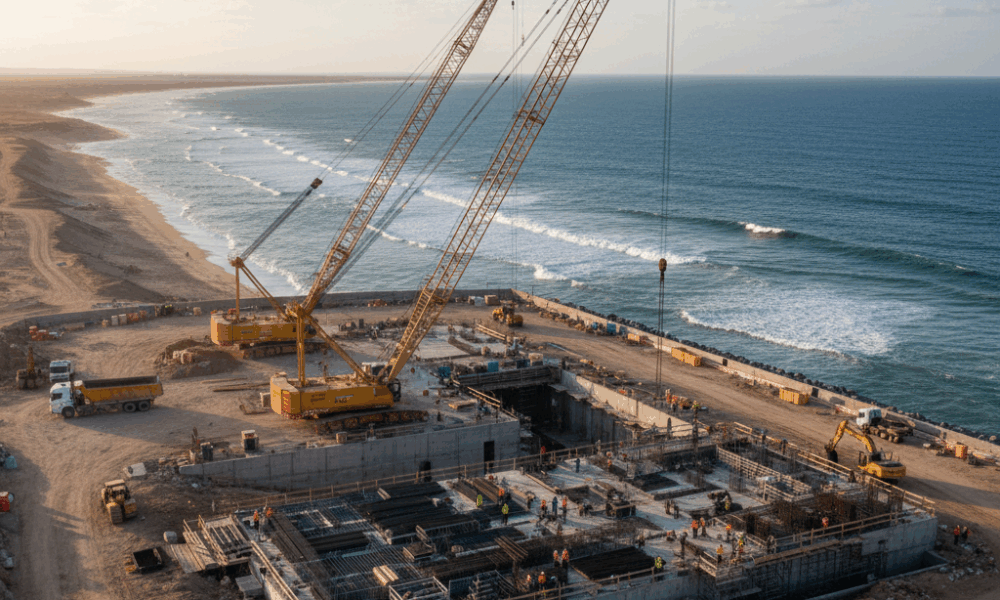

Explicit support for the autonomy plan triggers a virtuous circle for employment in Morocco. The regions of Laâyoune-Sakia El Hamra and Dakhla-Oued Ed-Dahab become growth platforms thanks to Port Dakhla Atlantic, wind and solar farms, and the rise of aquaculture. The multiplier effects translate into recruitment in logistics, industrial maintenance, IT applied to operations, and responsible tourism.

Investment scenarios show a potential of thousands of direct and indirect jobs. Companies anticipate needs for technicians, project managers, and commercial trades related to export. Young graduates in engineering, supply chain, and tourism can count on better-structured employment pools, supported by incubators and activity zones.

Driving Sectors and Regional Value Chains

Value chains extend from refrigerated freight for seafood to renewable energy components. The location of companies along the coast and towards Sahelian axes positions Morocco as a continental entry gate. This repositioning fosters the competitiveness of Moroccan SMEs and stimulates the creation of startups specialized in smart logistics.

| Sector ⚙️ | Potential Jobs 👥 | Key Skills 🧠 | Horizon 📆 | Local Effect 🌍 |

|---|---|---|---|---|

| Port & logistics | 3,000 – 5,000 | Supply chain, customs, data | Short term | Dakhla Cluster 🚢 |

| Renewable energy | 2,500 – 4,000 | O&M, HV, HSE | Medium term | Wind farms 💨 |

| Aquaculture & agro | 2,000 – 3,000 | Quality, cold, traceability | Short term | Local valorization 🐟 |

| Responsible tourism | 1,500 – 2,500 | Customer experience, e-tourism | Medium term | Ecotourism 🏝️ |

A concrete example: an aquaculture cooperative in Dakhla has planned to triple its capacity through secured export contracts. This perspective induces chain recruitments – from production engineering to last-mile logistics – while boosting practical training for local technicians.

- 🚀 Accelerator: Port Dakhla Atlantic as a regional hub.

- 🌱 Impact: green jobs and industrial upgrading.

- 🧳 Tourism: longer season and activity diversification.

- 🔗 Integration: export towards ECOWAS and niche markets.

- 💼 Inclusion: new pathways for youth and women.

To place this movement in the international dynamic, an analysis of American orientations highlights the ripple effects on investment flows.

Ultimately, employment in the Southern regions is envisioned as a matrix of opportunities where infrastructure, training, and markets align.

Skills, Training, and HR Policies Adapted to the New Horizon

The prospect of a resolution strengthening the autonomy plan requires an occupational mapping. Needs converge towards technical skills combined with behavioral aptitudes. Companies seek profiles capable of operating in open, multicultural, and digitalized environments, while respecting HSE standards and international compliance.

Moroccan institutions – universities, engineering schools, and OFPPT – have a solid base. The challenge is to accelerate short training cycles, international certification, and work-study programs. Bridges between Dakhla, Laâyoune, Agadir, and Casablanca facilitate talent mobility.

Skills Map and Training Formats

Three blocks structure demand: operations and maintenance, applied data, and project management. Programs combining simulation, workshops, and company immersion achieve the best insertion rates. Recruiters also value mastery of English and Spanish for regional exchanges.

| Skill 🎓 | Job Use 🧩 | Training Format 🧪 | Certification 📜 | Employability ✅ |

|---|---|---|---|---|

| O&M wind/solar | Field maintenance | Work-study + bootcamp | GWO/ISO | High 🔝 |

| Data & supply chain | Forecast, tracking | Labs + real projects | APICS/CSCP | Very high 🚀 |

| Quality & HSE | Compliance, audits | Practical workshops | ISO 9001/45001 | High ✅ |

| Sustainable tourism | Local experiences | Micro-certifications | GSTC | Good 🌟 |

- 🧠 Key soft skills: communication, problem-solving, ethics.

- 🌍 Languages: English and Spanish for regional integration.

- 🔄 Mobility: scholarships and inter-region internships.

- 🤖 Tech: planning tools, IoT, GIS.

- 📚 Continuous learning: quarterly upskilling.

For HR departments, the agenda is clear: work-study contracts, school partnerships, and updated skills frameworks. The link between the American diplomatic dynamic and recruitment strategies is now direct: anticipating needs saves growth cycles.

The watchword is agility: aligning skills upgrading with the opening of priority projects in the Southern regions.

Economic Diplomacy, African Corridors, and Investment Attractiveness

Stabilization of the file at the UN level consolidates Morocco’s economic diplomacy. Trade corridors to West Africa – road, maritime, and air – gain predictability. Investors positively assess regulatory visibility and operational continuity, decisive factors for financing heavy infrastructure and temperature-controlled logistics chains.

In this context, industrial zones and logistics platforms in the South can play a magnet role for subcontracting and nearshoring. Alignment with the AfCFTA opens margins on delivery times, documentary standardization, and customs fluidity.

Port Dakhla Atlantic and the Handover to Africa

Port Dakhla Atlantic becomes a symbol of regional integration. It captures diversified flows – seafood, industrial components, energy equipment – and anchors local transformation. Synergies with Agadir and Tanger Med favor route complementarity and freight cost optimization.

| Strategic Asset 🌐 | Employment Effect 💼 | Business Impact 📊 | Residual Risk ⚠️ | Mitigation 🛡️ |

|---|---|---|---|---|

| Atlantic corridor | Logistics, MRO | Cost reduction ⬇️ | Port bottlenecks | Slot planning 🗓️ |

| Political stability | Manager recruitment | Long-term capital | External volatility | Risk hedging 🧾 |

| Competitive energy | Green technicians | Productivity ↑ | Interconnections | Network redundancy 🔌 |

| ECOWAS markets | Regional sales | Export traction | Heterogeneous standards | Harmonization 📑 |

- 🧭 Project governance: binational PMO for corridors.

- 📦 Logistics: consolidation hubs in Dakhla.

- ⛽ Energy: green PPAs for industrial sites.

- 📜 Compliance: traceability and due diligence.

- 🤝 Economic diplomacy: targeted B2B missions.

A complementary insight on the American diplomatic offensive shows how political coherence attracts sensitive supply chains. Development banks and infrastructure funds favor territories with a 10 to 15-year visibility – a horizon compatible with port, energy, and industrial assets underway.

Overall, economic diplomacy catalyzes investments and anchors qualified jobs, with a ripple effect beyond the Southern regions.

Regulatory Framework, Local Governance, and Decent Employment Under Autonomy

The autonomy plan includes an institutional dimension directly concerning employers: local governance, investment framework, public procurement, and articulation with national law. Clear stability on these points accelerates company establishment and the creation of formal jobs respecting social and environmental standards.

Local authorities would benefit from deploying one-stop shops, predictable deadlines for permits, and social clauses in tenders. Access to public procurement, notably for SMEs in the Southern regions, becomes a lever for economic inclusion.

From Rule to Practice: Tools for Inclusive Growth

Implementation passes through operational measures: targeted tax incentives, pacts for local employment, and co-financed training mechanisms. Integration of ESG criteria, now standard for international funds, attracts capital and gives credibility to territorial projects.

| Public Lever 🏢 | Proposed Measure 🧰 | Employment Benefit 👥 | Indicator 📈 | Deadline ⏳ |

|---|---|---|---|---|

| One-stop shop | Permits in 30 days | Accelerated hiring | Average delay 🔽 | Short term |

| Public procurement | Local SME quotas | Integration TPE/SME | Adjudication rate 📊 | Short term |

| Tax incentives | R&D/training credits | Up/reskilling | Trained hours ⏫ | Medium term |

| ESG | Territorial labels | Capital attractiveness | FDI flows 💵 | Medium term |

- ⚖️ Transparency: e-procurement platforms.

- 🤝 Inclusion: local content clauses.

- 🌿 ESG: simplified reporting for SMEs.

- 🧩 Coordination: regional employment-skills committees.

- 💡 Innovation: green transition scholarships.

Companies that anticipate these frameworks gain time and talent. To link diplomacy and business, consulting the detailed analysis of American signals offers a strategic compass for human and financial capital allocation.

Operational conclusion: clear governance, inclusion, and compliance create a virtuous circle for decent employment in the Southern regions.

Strategic Reading for Recruiters, Entrepreneurs, and Young Graduates in Morocco

The UN moment is a strategic window. Recruiters, entrepreneurs, and candidates can leverage it to position themselves in high-demand professions and flagship projects. The key is to articulate diplomatic monitoring, sectoral choices, and skills development plans.

A fictitious project – “SudLink Logistics” – illustrates the trajectory: establishment in Dakhla, export contracts to West Africa, training partnerships with OFPPT, and robust HSE standards. In two years, the company triples its staff by mobilizing a local pool and experienced managers from Casablanca and Tangier.

Practical Roadmap, from CV to Supply Chain

Recruiters can build a matrix of critical positions, with a hiring calendar aligned with infrastructure commissioning. Candidates, in turn, bet on short certifications, field experience, and digital versatility.

| Profile 🎯 | Priority Action 🧭 | Tool/Certification 🧰 | Targeted Result 🏆 | Timeline ⏱️ |

|---|---|---|---|---|

| Logistics technician | Port internship | APICS/ERP | Fast hiring | 3–6 months |

| O&M engineer | Field bootcamp | GWO/ISO | Confirmed position | 6–9 months |

| Project manager | Agile/PMO | PMI/Prince2 | Reliable delivery | 4–8 months |

| Export sales | ECOWAS prospecting | Incoterms/Trade | Secured deals | 2–4 months |

- 🧭 Monitoring: follow the UN and resolution signals.

- 📚 Skills: short but recognized certifications.

- 🤝 Network: local coalitions of companies and schools.

- 🌍 Markets: focus on West Africa and sustainable niches.

- 🔒 Compliance: ESG, HSE, and business ethics.

To decode the ripple effects of the American position, a reading of the exclusive support for the autonomy plan sheds light on recruitment and investment decisions. In the coming weeks, everyone can turn multilateral news into a competitive advantage.

The final insight can be summed up in one sentence: anticipate, certify, collaborate – and make Southern Morocco a hub of qualified jobs.

Useful resource to complete strategic monitoring: the analysis of the diplomatic offensive and its impact on the employment-skills chain, as well as a summary of American positions at the UN.

{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”What does explicit UN support for the autonomy plan change for employment in Morocco?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”It improves visibility for investors, accelerates projects in the Southern regions (port, energy, aquaculture, tourism) and creates direct and indirect jobs. Recruiters can plan hires, while candidates target short and recognized certifications.”}},{“@type”:”Question”,”name”:”Which professions will be most sought after in case of a favorable resolution?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Logistics technicians, renewable O&M engineers, HSE/quality managers, project managers, export sales. Soft skills (communication, problem-solving) and mastery of English/Spanish will be decisive.”}},{“@type”:”Question”,”name”:”How can SMEs in the Southern regions benefit from the new dynamic?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”By accessing public procurement with dedicated quotas, aligning with ESG standards, and joining sectoral clusters (port, aquaculture, tourism). One-stop shops and predictable deadlines facilitate installation and growth.”}},{“@type”:”Question”,”name”:”What role does economic diplomacy play in the attractiveness of the contested territory?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”It secures investment flows and corridors to West Africa, increases funder confidence, and facilitates infrastructure financing. A clear UN resolution reduces country risk and attracts value chains.”}},{“@type”:”Question”,”name”:”Where to find a perspective on the American position?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”An analysis of the American initiative and its impact on the UN resolution is available via a specialized resource: the article detailing exclusive support for the autonomy plan and its implications for employment and investment.”}}]}What does explicit UN support for the autonomy plan change for employment in Morocco?

It improves visibility for investors, accelerates projects in the Southern regions (port, energy, aquaculture, tourism) and creates direct and indirect jobs. Recruiters can plan hires, while candidates target short and recognized certifications.

Which professions will be most sought after in case of a favorable resolution?

Logistics technicians, renewable O&M engineers, HSE/quality managers, project managers, export sales. Soft skills (communication, problem-solving) and mastery of English/Spanish will be decisive.

How can SMEs in the Southern regions benefit from the new dynamic?

By accessing public procurement with dedicated quotas, aligning with ESG standards, and joining sectoral clusters (port, aquaculture, tourism). One-stop shops and predictable deadlines facilitate installation and growth.

What role does economic diplomacy play in the attractiveness of the contested territory?

It secures investment flows and corridors to West Africa, increases funder confidence, and facilitates infrastructure financing. A clear UN resolution reduces country risk and attracts value chains.

Where to find a perspective on the American position?

An analysis of the American initiative and its impact on the UN resolution is available via a specialized resource: the article detailing exclusive support for the autonomy plan and its implications for employment and investment.

Comments are closed